s corp dividend tax calculator

Ad Use Our Free Dividend Calculator to Calculate Compound Returns and Reinvestments. The leftover funds are distributed as.

Tax Savings Calculator For Llc Vs S Corp Gusto

2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which are only.

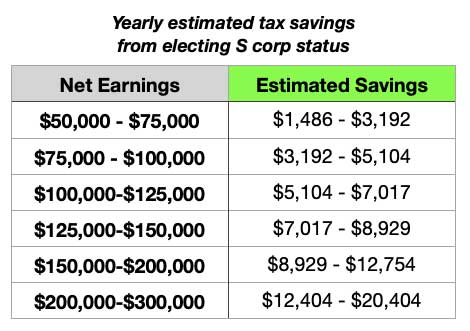

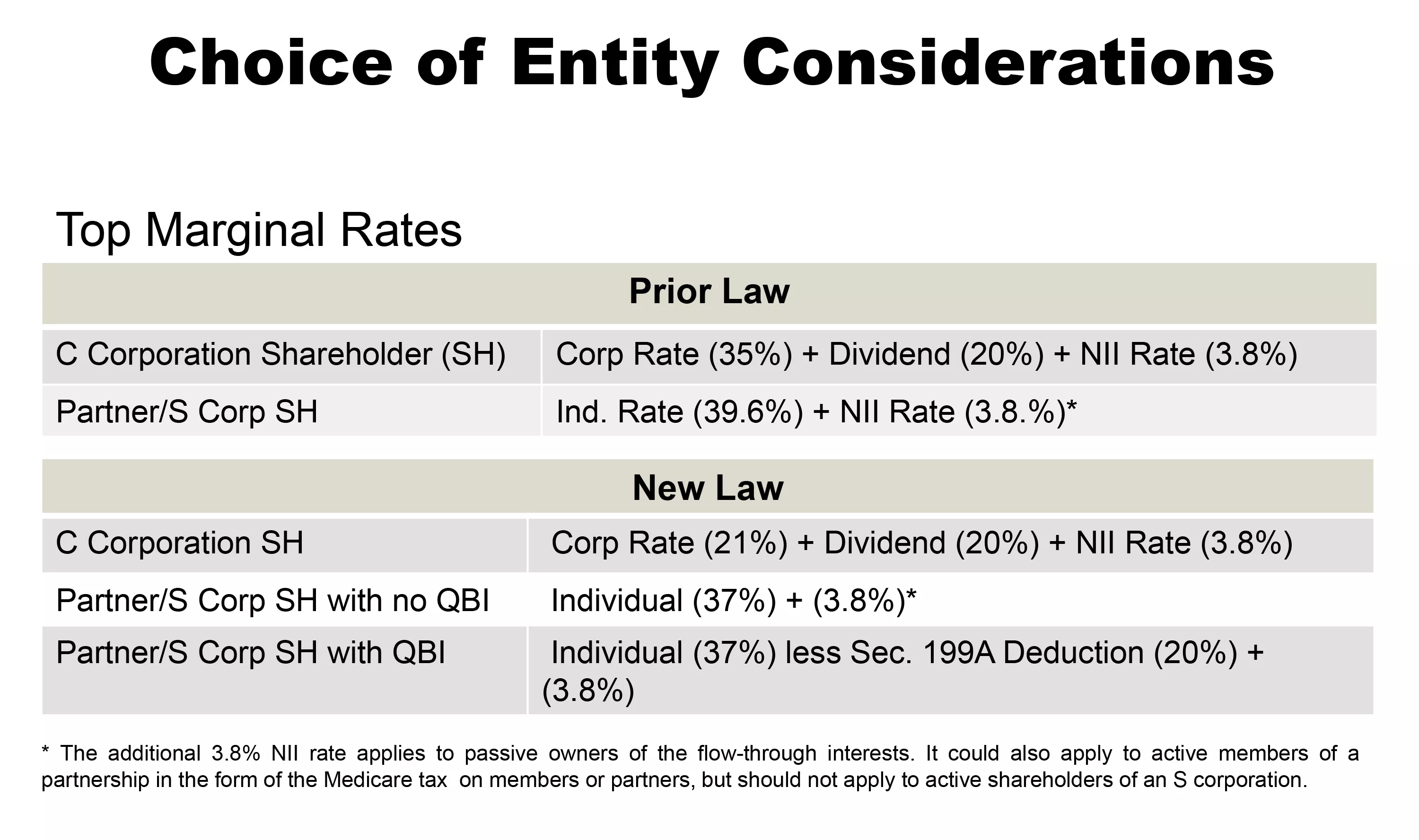

. The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS. If income is standard income you would pay the standard income tax rates. The SE tax rate for business owners is 153 tax.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Annual cost of administering a payroll. Tax calculator based on 2018 Tax Law.

Taxes Paid Filed - 100 Guarantee. Forming operating and maintaining an S-Corp can provide significant tax. With the use of our Dividend Tax Calculator you are able to discover how much income tax you will be paying with the input of your current salary and the annual dividend payments that you.

Overhead include yours and others salaries but not FICA tax Salary Paid to You. Total first year cost of S-Corp. If youre a basic-rate payer youll pay 75 on dividend income.

Estimated Local Business tax. Find out how much you could save in taxes by trying our free S-Corp Calculator. S-Corp Tax Savings Calculator.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Annual state LLC S-Corp registration fees. 875 of Dividend Income for income within the Basic Rate band of 20 3375 of Dividend Income for income within the Higher.

S corp qualified dividends usually refer to the dividends paid out of earnings accumulated during the tax years when an S corporation operated as a C corporation. You pay 75 on the next 1000. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

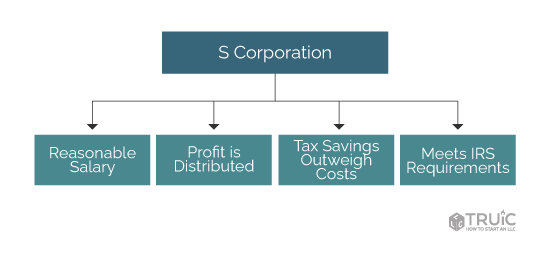

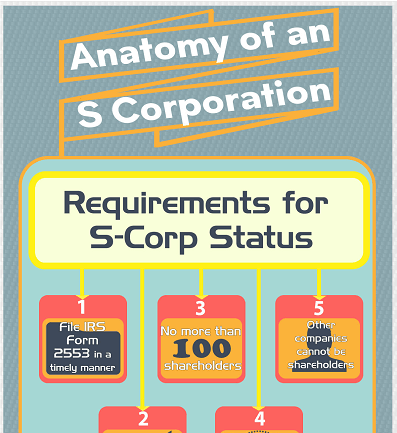

Taxes Paid Filed - 100 Guarantee. Call HMRC on 0300 200 3300 so they can change your tax code. An S corporation is not subject to corporate tax.

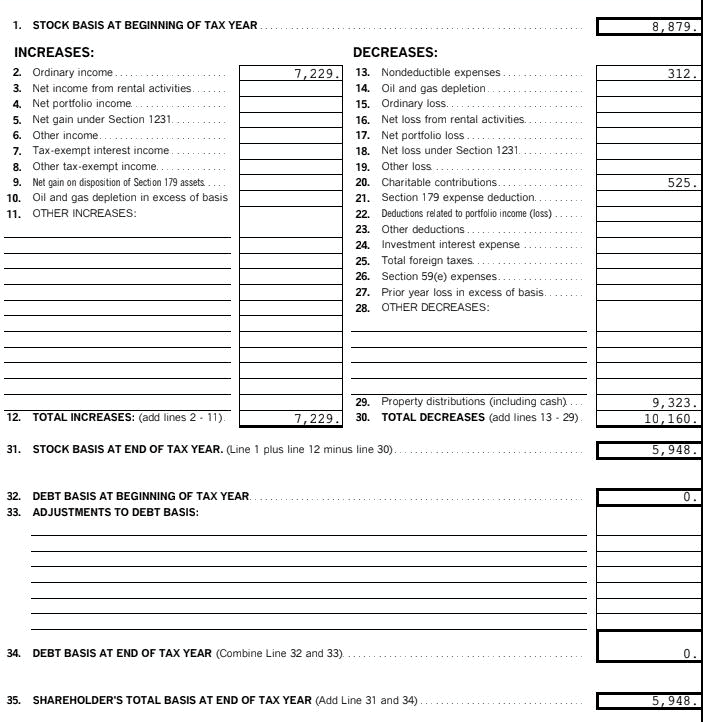

Get the spreadsheet template HERE. An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local income. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

If an S corp allocates 125000 profit to you the shareholder the character of such income is important. Property Tax Calculator. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Dividends are paid by C corporations after net income is calculated and taxed. S Corporation Distributions. Ad Easy To Run Payroll Get Set Up Running in Minutes.

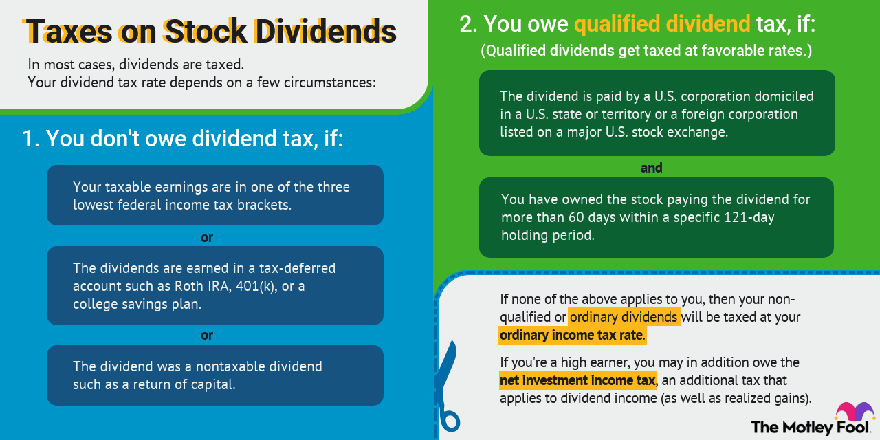

But if the income is long-term capital gains or qualified dividends you pay the lower preferential tax rates sometimes. Now for reference lets compare the the qualified dividend tax rates for 2021. If the income is ordinary income you pay the ordinary income tax rates.

S corp dividend tax calculator Tuesday March 1 2022 Edit. Ad Easy To Run Payroll Get Set Up Running in Minutes. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

For example if your one-person S corporation makes 200000 in profit and a. You dont pay any dividend tax on the first 2000 you make in dividends. Above your dividend allowance youll pay tax at the rate you pay your other income - known as your marginal tax rate.

S Corp Tax Savings Calculator Newway Accounting

Analyzing The New Oregon Corporate Activity Tax

S Corp Tax Treatment In California Guide For Freelancers Collective Hub

S Corporation Income Tax Calculator S Corp Calculator

%20Image%20(GD-665).png)

Small Business Tax Calculator Taxfyle

Here S How Much You Ll Save In Taxes With An S Corp Hint It S A Lot

S Corp Vs Llc Difference Between Llc And S Corp Truic

What Is A Delaware S Corp Taxes Harvard Business Services

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Corporate Tax In The United States Wikipedia

How To Pay Yourself From Your S Corp What Is A Reasonable Salary The Hell Yeah Group

Is Your Corporation Eligible For The Dividends Received Deduction Cordasco Company

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

:max_bytes(150000):strip_icc()/GettyImages-532459366-575ea5ec5f9b58f22e8cd8bf.jpg)